How to Monetize Clothing Overstock: Proven Strategies to Sell Excess Inventory and Turn Surplus into Profit

Successfully monetizing clothing overstock has been revolutionized by modern B2B liquidation platforms that consistently achieve 50-70% recovery rates—more than double traditional wholesale liquidation returns of 15-30%.

This comprehensive guide reveals how specialized platforms transform excess inventory from a financial burden into profitable revenue streams, alongside supplementary strategies including traditional wholesale liquidation, clearance optimization, and proactive inventory management to prevent future surplus accumulation.

The fashion industry's rapid trend cycles and unpredictable demand often lead to significant clothing overstock. Retailers and manufacturers find themselves with excess inventory, tying up capital and straining storage capabilities. Successfully monetizing this surplus is crucial for financial health. Modern B2B liquidation platforms have fundamentally transformed this challenge, enabling brands to recover 50-70% of wholesale investment compared to the 15-30% typical of traditional liquidation channels. This article explores proven strategies to convert clothing overstock into revenue, starting with efficient B2B platform solutions, then examining traditional wholesale liquidation alternatives, optimized clearance sales, and proactive inventory management to prevent future surpluses.

Understanding clothing overstock and excess inventory challenges

The fashion sector grapples with unique inventory management issues. Clothing overstock arises when retailers and manufacturers possess more merchandise than they can sell through typical channels, significantly straining cash flow and storage capabilities.

What is clothing overstock

Clothing overstock refers to excess merchandise inventory that exceeds a retailer's or manufacturer's ability to sell through normal sales channels within reasonable timeframes, resulting in tied-up capital and increased storage costs.

Several factors exacerbate this ongoing problem. Fashion trends change rapidly, making accurate demand forecasting difficult. A popular item one season might become outdated the next, leaving businesses with large quantities of unsellable goods. Furthermore, the pursuit of better wholesale prices often leads companies to place larger orders than justified by actual demand. This creates a cycle where initial cost savings on individual items lead to overall losses due to unsold inventory.

Key challenges of excess inventory

- Cash flow strain: Capital remains tied up in unsold merchandise instead of generating revenue

- Storage costs: Warehousing expenses accumulate for slow-moving or stagnant inventory (€1,000-€3,000 per month for typical volumes)

- Opportunity cost: Retail space occupied by surplus stock could be used for new, profitable merchandise

- Inventory depreciation: Fashion items lose 2-5% of value monthly as trends change seasonally

- Demand forecasting difficulty: Unpredictable consumer preferences make accurate inventory planning challenging

- Margin erosion: Traditional liquidation methods recover only 15-30% of wholesale cost

The financial repercussions extend beyond the cost of unsold items. Warehousing costs accumulate, valuable retail space is occupied by slow-moving products, and capital that could be invested in new merchandise remains tied up in stagnant stock. Each month of delay adds carrying costs while inventory depreciates 2-5%, making prompt action crucial. Modern B2B platforms have emerged as the primary solution to these challenges, transforming how fashion brands monetize excess inventory.

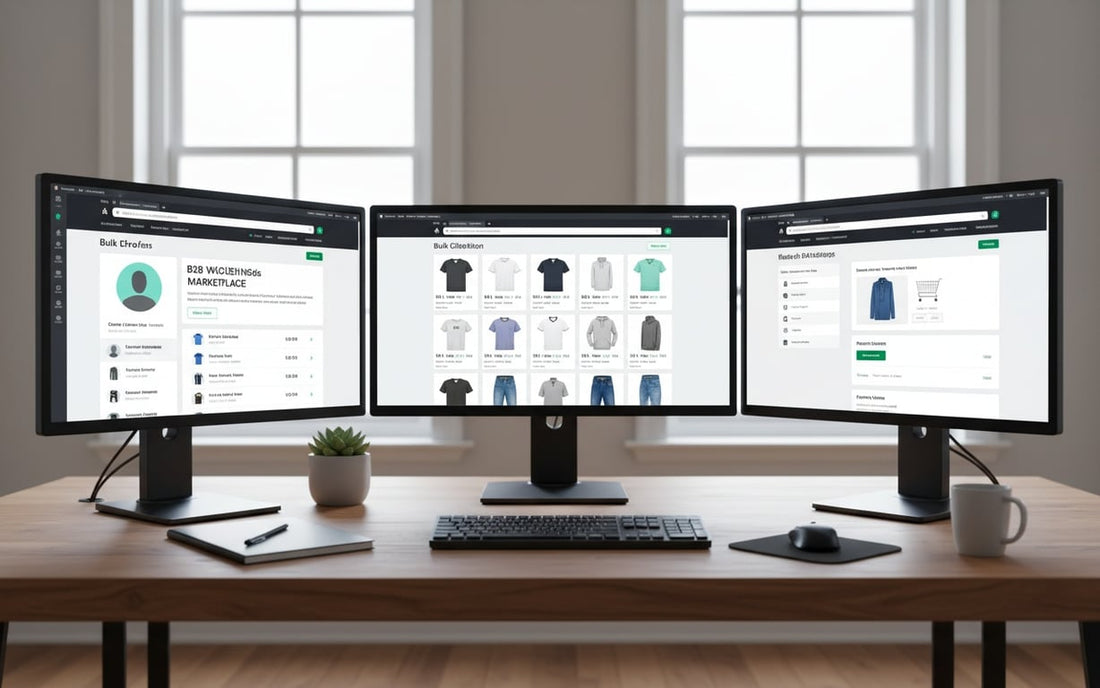

Modern B2B platforms: the primary monetization strategy achieving 2x traditional returns

The most significant evolution in clothing overstock monetization has been the emergence of specialized B2B liquidation platforms that fundamentally transform recovery economics. Where traditional wholesale liquidation typically achieves 15-30% of wholesale cost, modern platforms consistently deliver 50-70% recovery rates through competitive buyer networks and optimized matching algorithms—more than doubling financial outcomes while dramatically reducing time to monetization.

Why B2B Platforms Outperform Traditional Liquidation by 100%+

Platforms like Unfrosen have built comprehensive verified buyer networks that eliminate traditional liquidation inefficiencies. The structural advantages create measurable financial superiority:

Direct buyer access eliminates intermediary margins

Traditional liquidation involves selling to intermediaries who purchase at 15-30% of wholesale for resale at 50-80% margins. B2B platforms connect brands directly with end buyers—retailers and boutiques purchasing for their own operations—eliminating this intermediary markup. The result: brands capture 50-70% of wholesale value that traditional liquidators would have kept as their resale margin.

Consider a €100,000 wholesale cost inventory lot. Traditional liquidators offer €20,000-€30,000, planning to resell at €50,000-€60,000 for substantial profit. B2B platforms connect you directly with those eventual buyers, enabling you to capture €50,000-€70,000 directly—a €30,000-€40,000 improvement on identical inventory.

Competitive bidding drives prices vs. single-buyer negotiations

Traditional liquidation involves negotiating with one or two liquidators, creating minimal price competition. B2B platforms expose inventory to thousands of verified buyers (3,800+ on Unfrosen), creating genuine competitive environments where multiple buyers bid prices upward. This competition consistently produces 30-50% higher prices than single-buyer traditional liquidation.

Transaction speed prevents further depreciation

Traditional liquidation often requires 4-12 weeks of buyer identification, negotiation, and logistics coordination. During this period, inventory continues depreciating 2-5% monthly while accumulating €1,000-€3,000 monthly storage costs. B2B platforms complete transactions in 3-7 days, preventing this additional value erosion. On €100,000 inventory, two months of traditional negotiation costs €2,000-€6,000 in storage plus €4,000-€10,000 in depreciation—losses eliminated by platform speed.

Brand protection prevents channel conflicts

Traditional liquidators often resell through channels creating brand conflicts—discount stores where your full-price customers might discover heavily discounted inventory. B2B platforms offer anonymous listing capabilities, geo-blocking, and controlled visibility preventing these damaging scenarios. This brand protection enables premium and mid-tier brands to liquidate inventory that traditional channels would risk devaluing permanently.

Core Advantages of B2B Liquidation Platforms

- Superior recovery rates: Achieve 50-70% of wholesale cost vs. 15-30% traditional liquidation—doubling or tripling returns

- Rapid monetization: Complete transactions in 3-7 days vs. 4-12 weeks traditional timeline

- Verified buyer networks: Access 3,800+ pre-qualified retailers eliminating due diligence burden

- Complete brand protection: Anonymous listings, geo-blocking, and visibility controls preventing channel conflicts

- Zero operational burden: Full-service logistics management handling negotiations, shipping, and coordination

- Guaranteed upfront payment: Immediate cash flow vs. uncertain consignment or delayed payment terms

- No hidden fees: Zero commission structure vs. 10-20% marketplace fees or liquidator margins

- Geographic expansion: Access European markets across 10+ countries without export complexity

- Prevented depreciation: Rapid transactions eliminate 2-5% monthly value loss during prolonged liquidation

- Eliminated carrying costs: Quick completion prevents €1,000-€3,000 monthly storage expenses

Real-World Financial Impact: Platform vs. Traditional Comparison

The financial advantage becomes clear through practical scenarios:

Example 1: €100,000 wholesale cost inventory (Grade A, current season)

Traditional liquidation approach:

- 8-12 weeks buyer identification and negotiation

- Recovery: €20,000-€30,000 (20-30% of wholesale)

- Carrying costs during negotiation: €2,000-€6,000 (2-3 months storage)

- Depreciation during delay: €4,000-€10,000 (2-5% monthly for 2-3 months)

- Net recovery: €14,000-€24,000 after costs

- Recovery rate: 14-24% of original wholesale investment

B2B platform approach:

- 3-7 days submission to completion

- Recovery: €50,000-€70,000 (50-70% of wholesale)

- Carrying costs during transaction: €0-€500 (under 1 week)

- Depreciation during transaction: Minimal (under 1 week)

- Net recovery: €49,500-€70,000 after minimal costs

- Recovery rate: 49.5-70% of original wholesale investment

Platform advantage: €35,500-€46,000 superior outcome (250-350% better return)

Example 2: €50,000 wholesale cost inventory (Grade B, prior season)

Traditional liquidation: €7,500-€15,000 recovery (15-30%) minus €2,000-€4,000 costs = €5,500-€13,000 net (11-26%)

B2B platform: €20,000-€30,000 recovery (40-60%) minus minimal costs = €19,500-€30,000 net (39-60%)

Platform advantage: €14,000-€17,000 superior outcome (150-250% better return)

The Modern Platform Process: Five Steps to Superior Returns

Where traditional liquidation requires weeks of buyer identification, outreach, negotiation, and logistics coordination, modern platforms streamline monetization into a simple five-step process:

- Submit inventory documentation: Upload stocklists with merchandise specifications, quantities, and condition grades

- Configure visibility preferences: Choose anonymous listings for maximum brand protection or selective visibility for targeted distribution

- Automatic buyer matching: Platform algorithms instantly connect inventory with relevant verified buyers from 3,800+ network

- Review and approve terms: Evaluate proposed pricing (typically 50-70% of wholesale for quality inventory) with flexibility to negotiate

- Receive payment and logistics support: Upfront payment processed while platform coordinates all pickup and delivery

This streamlined process reduces traditional 8-12 week timelines to 3-7 days while simultaneously achieving 2-3x better financial outcomes. For comprehensive information about platform operations, including buyer verification and transaction mechanics, review the frequently asked questions about wholesale clothing stock platforms.

When B2B Platforms Deliver Maximum Value

Modern B2B liquidation platforms are particularly effective for:

- Quality inventory (Grades A-B): Current or prior season merchandise in good condition commanding premium recovery rates

- Volume requirements: Typically 500+ units where platform efficiencies create substantial value

- Brand-sensitive liquidation: Premium and mid-tier brands requiring discretion to avoid channel conflicts

- Multi-category clearance: Mixed inventory spanning apparel, footwear, and accessories

- Time-sensitive situations: Seasonal transitions or cash flow needs requiring rapid completion

- Maximizing recovery rates: Any situation where 50-70% recovery significantly outperforms 15-30% traditional returns

For most fashion brands and retailers managing excess inventory, B2B platforms represent the optimal primary monetization strategy. However, understanding traditional liquidation methods remains valuable for specific scenarios and supplementary approaches.

Traditional wholesale liquidation channels - secondary monetization options

Traditional wholesale liquidation represents the conventional approach to converting clothing overstock into immediate revenue, predating modern B2B platforms. This involves selling large quantities of merchandise to specialized intermediary buyers who resell through their established distribution networks.

While offering immediate cash transactions, traditional liquidation typically achieves only 15-30% of wholesale cost due to intermediaries requiring substantial margins for their eventual resale. This creates the structural disadvantage: you receive 15-30% while the liquidator captures 50-80% markup when reselling—precisely the value that B2B platforms enable you to capture directly.

When traditional liquidation remains relevant

Despite significantly lower recovery rates compared to B2B platforms, traditional liquidation companies serve specific situations:

- Extremely distressed inventory (Grade C): Heavily damaged, aged, or otherwise impaired merchandise that platforms may not accept

- Sub-minimum quantities: Very small lots (under 200-300 units) below platform minimums

- Absolute urgency: Rare situations requiring cash within 24-48 hours regardless of recovery rate sacrifice

- Geographic limitations: Regions outside platform service areas or export capabilities

How traditional wholesale liquidation works

- Inventory assessment and cataloging of all excess merchandise by category, brand, and condition

- Research and contact traditional liquidation companies specializing in your merchandise type

- Request quotes from multiple liquidators to compare pricing (expect 15-30% of wholesale for quality goods)

- Negotiate payment terms, pickup logistics, and amounts—but recognize limited leverage with single-buyer scenarios

- Prepare merchandise for pickup with proper sorting and documentation

- Complete transaction accepting 50-70% lower recovery than B2B platform alternatives

Traditional liquidation limitations

- Recovery rates: Only 15-30% of wholesale cost vs. 50-70% via platforms—accepting €30,000 vs. receiving €60,000 on €100k inventory

- Opaque pricing: Limited visibility into whether offers reflect true market value vs. platform competitive transparency

- Minimal competition: Negotiating with 1-2 liquidators vs. thousands of platform buyers bidding competitively

- Extended timelines: Often 4-8 weeks vs. 3-7 days platform completion

- Brand risk: Limited control over eventual resale channels vs. platform visibility controls

Pricing in traditional wholesale liquidation typically ranges from 10% to 30% of original wholesale value, based on brand recognition, condition, seasonality, and demand. While this may seem low—and is substantially lower than B2B platform outcomes—the transaction provides immediate cash for severely distressed inventory that might not qualify for platforms.

Before committing to traditional liquidation, compare expected outcomes against B2B platform performance. The 35-40 percentage point recovery difference often represents €30,000-€40,000 in foregone value on typical inventory lots—substantial capital that efficient platforms enable you to capture.

Where to sell bulk clothes - understanding buyer landscape and platform advantages

The market for bulk clothing sales encompasses diverse buyer segments, each with specific purchasing criteria and operational models. Modern B2B platforms provide instant access to this entire landscape, while traditional approaches require manual identification and relationship building with individual buyer types.

Types of bulk clothing buyers accessible via platforms

- Discount retailers: Chain stores and outlet centers seeking brand-name items at reduced prices—platforms connect you directly vs. through liquidator intermediaries

- Independent boutiques: Specialty retailers purchasing quality excess inventory for curated selections—platform networks include 3,800+ verified stores

- Online resellers: E-commerce businesses specializing in discounted fashion merchandise—platforms reach these buyers instantly vs. manual marketplace listing

- Regional retailers: Geographic-specific buyers across European markets—platforms provide access without establishing physical presence

- Category specialists: Buyers focusing on specific product types (footwear, accessories, etc.)—platform algorithms match inventory to specialized buyers automatically

Discount retailers represent a major market segment traditionally accessed through liquidator intermediaries. However, platforms enable direct connections, allowing you to capture the 50-70% that discount retailers pay liquidators, rather than accepting the 20-30% liquidators pass to you. These buyers regularly source stock from platforms specializing in wholesale fashion, including clothes, footwear, accessories, and other off-price stock.

Platform advantages vs. traditional buyer search

Traditional approaches required weeks identifying appropriate buyers, verifying legitimacy, negotiating individually, and coordinating varied logistics requirements. Modern B2B platforms eliminate this complexity:

- Instant access: Submit once to reach 3,800+ verified buyers vs. weeks identifying individual contacts

- Verified networks: All buyers pre-qualified through business registration, tax verification, and reputation checks vs. unknown contact risks

- Automated matching: Algorithms connect your inventory with buyers seeking those specific categories vs. trial-and-error outreach

- Competitive pricing: Multiple buyers bidding drives prices 30-50% higher vs. single-buyer negotiations

- Unified logistics: Platform coordinates all shipping vs. managing varied buyer requirements individually

For comprehensive understanding of how B2B platforms operate for sellers, including inventory acceptance criteria, buyer verification processes, and transaction mechanics, explore dedicated B2B solutions for excess fashion inventory.

Success in bulk monetization lies in prioritizing efficient channels providing instant buyer access and competitive pricing, supplemented by traditional direct relationships for specialized needs. This ensures optimal recovery rates while minimizing time investment.

Working with traditional clothing liquidation companies - when to use conventional services

Traditional liquidation companies offer specialized services that can complement B2B platform strategies for specific inventory situations. Understanding their capabilities and appropriate use cases helps optimize overall monetization approaches.

How traditional liquidation companies operate

Conventional liquidators purchase inventory outright at 15-30% of wholesale for redistribution through their networks. They provide immediate transactions but capture 50-80% resale margins that B2B platforms enable sellers to access directly. This structural disadvantage makes them secondary options for most quality inventory.

When traditional partners add value

- Distressed inventory management: Grade C merchandise too damaged or aged for platform acceptance

- Specialized disposal needs: Inventory requiring destruction or recycling for brand protection beyond liquidation

- Extreme urgency situations: Rare 24-48 hour cash needs where recovery rate sacrifice is acceptable

- Very small quantities: Sub-200 unit lots below typical platform minimums

- Supplementary capacity: Backup options when platform demand for specific categories is temporarily low

Selecting traditional liquidation partners

- Evaluate experience with your specific merchandise categories and brand types

- Request references from previous clients and verify track records

- Compare pricing structures—but recognize 15-30% offers are structural vs. 50-70% platform rates

- Assess service levels and logistics capabilities for specialized needs

- Review buyer networks understanding they're intermediary channels vs. platform direct access

- Use primarily for distressed inventory while routing quality goods to B2B platforms

Reputable traditional companies provide transparent pricing based on inventory assessments considering brand strength, condition, seasonality, and demand. However, their 15-30% offers reflect intermediary positioning—they must purchase low enough to resell at 50-70% while maintaining margins. B2B platforms eliminate this intermediary layer, allowing sellers to capture the full market value.

Payment terms vary significantly. Some traditional liquidators offer immediate payment, while others pay after eventual sales completion. Platform-based liquidation provides guaranteed upfront payment within days, eliminating this uncertainty while achieving superior recovery rates.

Fashion stock clearance strategies and pricing optimization

Direct clearance sales represent supplementary monetization strategies for specific inventory situations, particularly when brand relationships or customer loyalty justify the operational investment. While potentially achieving higher per-unit returns than wholesale channels, clearance requires significant marketing, operational resources, and careful brand management.

Effective clearance pricing strategies

- Tiered pricing: Progressive discounts starting moderate (30-40% off) and increasing to 60-75% over weeks, creating urgency while testing price elasticity

- Bundle pricing: Grouping items or offering quantity discounts encouraging larger purchases and faster inventory turnover

- Market segmentation: Different pricing for customer segments (email list vs. general public) based on loyalty and purchasing patterns

- Seasonal timing: Aligning clearances with natural buying cycles (end-of-season) for maximum receptivity

- Volume incentives: Deeper per-unit discounts for multi-item purchases accelerating inventory movement

Clearance vs. B2B platform economics

Direct clearance potentially achieves 40-60% of original retail value (20-30% of wholesale cost if items sold at 50% off original retail). However, this requires:

- Marketing investment: Email campaigns, social media advertising, and promotional costs

- Operational resources: Staff time for customer service, fulfillment, and returns management

- Extended timelines: Often 4-8 weeks to achieve full clearance vs. 3-7 days platform completion

- Brand risk: Heavy discounting visible to full-price customers potentially damaging future willingness to pay

- Uncertain outcomes: No guaranteed completion unlike platform upfront offers

For most brands, B2B platforms deliver comparable or superior financial outcomes (50-70% of wholesale = 25-35% of retail) without operational burden, timeline uncertainty, or brand risk. Clearance makes sense primarily for brands with strong direct customer relationships, excess marketing capacity, or inventory unsuitable for wholesale channels.

Timing considerations favor rapid platform-based monetization. Each week of clearance delay costs €250-€750 in storage while inventory depreciates 0.5-1.25%. Platform completion in 3-7 days prevents these costs while achieving comparable or better net recovery after accounting for clearance expenses.

Implementing effective clothing inventory management to prevent future overstock

Prevention represents the most cost-effective approach to managing overstock. Implementing robust systems reduces future surplus likelihood while maintaining adequate stock to meet demand. Even with efficient B2B liquidation platforms enabling 50-70% recovery, preventing overstock eliminates the 30-50% loss inherent in any liquidation.

Steps to implement proactive inventory management

- Install data analytics tools to process sales data and identify demand patterns with predictive accuracy

- Establish real-time inventory tracking systems with automated alerts flagging slow-moving items at 60-90 day thresholds

- Develop flexible ordering strategies with smaller, more frequent orders aligned to actual demand vs. bulk discounts

- Create vendor partnerships with consignment, return privileges, or flexible terms reducing inventory risk

- Implement quarterly inventory reviews and forecasting adjustments based on market trends and performance data

- Train staff on inventory management best practices and early warning indicators preventing overstock accumulation

- Establish proactive liquidation triggers (e.g., automatic platform submission at 90 days unsold) preventing Grade A inventory from aging to Grade B

Cost-benefit of prevention vs. efficient liquidation

Consider €100,000 wholesale cost inventory that becomes overstock:

- Prevention through better forecasting: Avoided overstock = €0 loss (100% capital preserved)

- Early B2B platform liquidation (Grade A): €60,000-€70,000 recovery = €30,000-€40,000 loss (60-70% capital preserved)

- Delayed traditional liquidation (aged to Grade B): €15,000-€25,000 recovery after costs = €75,000-€85,000 loss (15-25% capital preserved)

This hierarchy demonstrates why prevention remains optimal, but also why efficient B2B liquidation dramatically outperforms traditional approaches when overstock occurs. Modern platforms have transformed liquidation from a worst-case scenario into a viable inventory management tool, though prevention still delivers superior economics.

Data-driven forecasting forms the foundation of effective inventory management. Analytics tools processing sales data, market trends, and external indicators provide increasingly accurate demand predictions over time, reducing overstock frequency while maintaining service levels.

Flexible ordering balances cost efficiency with inventory risk. Smaller, more frequent orders aligned to actual demand may slightly increase per-unit costs but dramatically reduce overstock risk and associated liquidation losses. When liquidation loses 30-50% of capital even via efficient platforms, slightly higher procurement costs preventing overstock deliver superior net economics.

Measuring success and optimizing your clothing overstock monetization strategy

Continuous improvement requires systematic measurement and analysis of key performance indicators across all monetization channels. Tracking comprehensive metrics enables data-driven decisions optimizing strategy refinement.

Essential metrics for overstock monetization

- Recovery rate by channel: Percentage of original wholesale cost recovered—track separately for B2B platforms (expect 50-70%), traditional liquidation (15-30%), and clearance sales (20-30% net after expenses)

- Time to monetization: Speed of converting excess inventory to cash by channel—B2B platforms (3-7 days), traditional (4-12 weeks), clearance (4-8 weeks)

- Total cost of liquidation: Recovery rate minus carrying costs, depreciation, and operational expenses revealing true net outcomes

- Channel effectiveness: Comparative analysis revealing which approaches deliver optimal results for different inventory grades and categories

- Prevented depreciation: Value preserved through rapid B2B platform monetization vs. deterioration during traditional timelines

- Cash flow acceleration: Working capital improvements from rapid platform completion vs. extended traditional processes

Benchmark performance across channels

Comprehensive tracking reveals dramatic channel differences:

| Metric | B2B Platforms | Traditional Liquidation | Direct Clearance |

|---|---|---|---|

| Recovery Rate | 50-70% of wholesale | 15-30% of wholesale | 20-30% net after costs |

| Timeline | 3-7 days | 4-12 weeks | 4-8 weeks |

| Operational Burden | Minimal (full-service) | Low (outright sale) | High (marketing, fulfillment) |

| Brand Protection | High (anonymous options) | Low (limited control) | Medium (direct control with risk) |

| Carrying Costs During Process | €0-€500 (under 1 week) | €2,000-€6,000 (2-3 months) | €2,000-€4,000 (1-2 months) |

Recovery rate represents the most fundamental metric, but total cost accounting including prevented depreciation and avoided carrying costs reveals even larger platform advantages. On €100,000 wholesale inventory, platforms deliver €60,000-€70,000 gross recovery minus €500 costs = €59,500-€69,500 net (59.5-69.5%). Traditional liquidation achieves €25,000 gross minus €4,000 costs = €21,000 net (21%)—a €38,500-€48,500 platform advantage.

Time to monetization measures conversion speed directly impacting carrying costs and cash flow. Platforms completing in 3-7 days eliminate €2,000-€6,000 storage costs incurred during 4-12 week traditional processes—additional value beyond recovery rate differences.

Channel effectiveness analysis comparing performance across different merchandise grades and categories optimizes future routing decisions. Premium brands (Grade A) achieving 65-70% via platforms might receive only 25-30% traditionally—a 40 percentage point difference. Basic items (Grade B) might show smaller but still substantial gaps (45-55% platform vs. 15-20% traditional).

Regular strategy reviews incorporating lessons from each liquidation cycle ensure continuous optimization. While B2B platforms consistently outperform traditional channels for quality inventory, tracking results validates this advantage while identifying specific scenarios where alternative approaches might supplement primary platform strategies.

Turning Overstock into Opportunity Through Modern Monetization

Effectively monetizing clothing overstock has been revolutionized by modern B2B liquidation platforms that consistently achieve 50-70% recovery rates—more than double the 15-30% typical of traditional wholesale liquidation. By prioritizing efficient platform-based solutions that complete in 3-7 days while preventing depreciation and carrying costs, fashion brands and retailers can transform excess inventory from a significant financial burden into manageable capital recovery achieving 2-3x better outcomes than conventional methods.

The strategic approach combines B2B platforms as the primary monetization channel for quality inventory (Grades A-B), supplemented by traditional liquidation for distressed merchandise, direct clearance for brands with strong customer relationships, and proactive inventory management to prevent future surplus accumulation. Understanding the dramatic financial differences—€60,000-€70,000 platform recovery vs. €20,000-€30,000 traditional recovery on €100,000 inventory—enables informed channel selection maximizing capital preservation.

To optimize your monetization strategy, begin by assessing current excess inventory using professional grading systems (A, B, C), submitting quality merchandise to specialized B2B platforms for competitive buyer access, reserving traditional channels for distressed inventory requiring immediate clearance regardless of recovery rate sacrifice, and implementing proactive management systems preventing future overstock through improved forecasting and flexible ordering. By embracing these modern approaches and understanding their measurable financial advantages, fashion businesses can strengthen resilience and profitability while transforming a common industry challenge into an efficiently managed operational process.